Have you noticed how Canadian cities are changing? More families are living together. Rents are climbing. Housing feels tighter than ever. In the middle of all this, there’s a fresh idea that’s turning heads: the Secondary Suite Incentive Program (SSIP).

Now, if you are scratching your head wondering, “What on earth is a secondary suite, and why should I care?” you’re not alone. When I first heard about it, I thought it was just another government buzzword. But once I dug deeper, I realized this could be a game-changer for homeowners, families, renters, and even investors.

This article is your complete, down-to-earth guide. No jargon. No confusing government talk. Just clear insights, real examples, and the answers you’re probably already searching for.

What exactly is a Secondary Suite?

A secondary suite is a private, self-contained living space inside or attached to your main home. It’s like having a tiny home within your home.

Usually, it has:

- Its own kitchen: so residents can cook their own meals.

- Its own bathroom: giving privacy and comfort.

- A separate entrance: so people can come and go without disturbing the main household.

- Living and sleeping space: sometimes with a small living area or storage.

Secondary suites are perfect for family members, older kids, caregivers, or even as a rental to earn extra income. They give privacy, flexibility, and can even add value to your property.

Common types of secondary suites

| Type | Description |

| Basement apartments | Classic in-law suites or student rentals. |

| Garage conversions | Turning unused space above or beside your garage into a livable unit. |

| Laneway houses | Small homes built in the backyard, often facing a lane or alley. |

| Upper-level units | Converting part of your house into a private apartment. |

If you can imagine it, it probably qualifies as a secondary suite.

Why they matter?

Secondary suites solve two problems at once. Homeowners get extra income, and renters get affordable housing.

Short Story

The Singh family in Brampton had a basement full of old boxes and furniture that went unused for years. With some planning, they turned it into a cozy apartment.

Now, a young couple rents it at below-market rates, while the Singhs collect $1,300 a month that goes straight toward their mortgage. Everyone wins.

Why Canada is Encouraging Secondary Suites?

Housing is getting tougher for many Canadians. Young families struggle to buy their first home. Retirees live in houses that feel too big but aren’t ready to sell. Students, newcomers, and lower-income renters often can’t find affordable, safe places to live.

Secondary suites are a simple, practical solution, and the government is backing them. Here is why they matter:

| Why Secondary Suites Matter | How It Helps |

| Add rental units quickly | Homeowners can create a basement, garage, or laneway suite without building whole new neighborhoods. |

| Earn extra income | Rent helps cover mortgage payments, property taxes, and maintenance costs. |

| Support multi-generational living | Families can live close together while keeping their own space. |

| Use urban land efficiently | More people can live in the same space in crowded cities. |

| Strengthen communities | Creates safe, mixed-income neighborhoods where people support each other. |

Real-life example

In Vancouver, Helen, a retired widow, built a laneway house in her backyard. She rents it to a single mother at an affordable rate.

The rent covers Helen’s rising property taxes while giving another family a safe, stable home. This small change benefits two households and has a positive impact on the entire community.

Government support

The Secondary Suite Incentive Program (SSIP) helps homeowners access grants or low-interest loans to build legal suites. The goal is to remove financial barriers so more Canadians can benefit, both renters and homeowners.

Secondary suites aren’t just about money. They’re about rethinking how we live together in Canadian communities: smarter, closer, and more affordable.

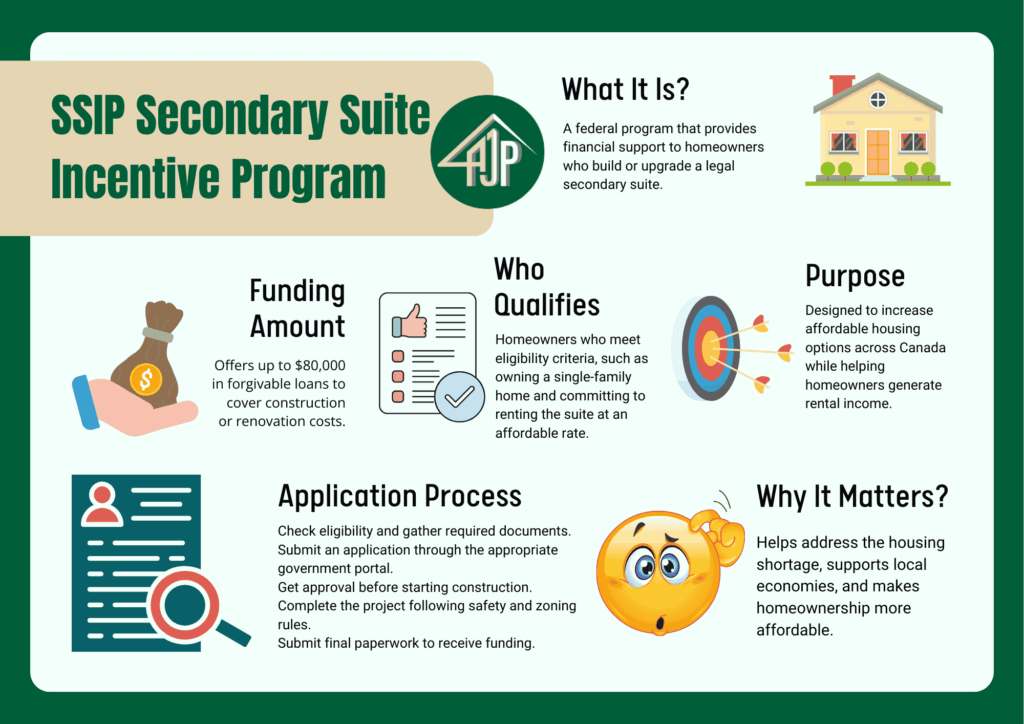

What is the Secondary Suite Incentive Program (SSIP)?

Alright, let’s get into the meat of it.

The Secondary Suite Incentive Program is a federal initiative that gives homeowners up to $40,000 in forgivable loans to create a secondary suite in their property.

Sounds good, right? But here is the key detail:

- The loan can be partially forgiven (up to 50 percent) if you rent the unit out at an affordable rate.

In simple words: the government is rewarding you for helping fix the housing crisis.

For example

- If you spend $50,000 building a basement apartment, you might receive $40,000 as a loan.

- If you rent that unit at an affordable rate, you could get $20,000 of that loan completely forgiven.

That is not just support, that is real money in your pocket.

Who Can Apply for SSIP?

Many people’s first question is: “Do I even qualify?” Here’s a simple breakdown:

| Requirement | Details |

| Canadian homeowner | You must own the home you plan to build the suite in. |

| Primary residence | The property must be where you live most of the time. |

| Legal location | The property must be in an area where secondary suites are allowed. |

| New construction | SSIP only supports building a new suite, not upgrading an existing rental. |

| Building codes & safety | The suite must meet all local regulations for safety and habitability. |

| Paperwork & permits | You’ll need permits and documentation to prove the suite meets the requirements. |

Short Story

The Martins in Calgary wanted to upgrade their old, illegal basement rental into a legal suite. Unfortunately, SSIP does not cover renovations and only applies to new builds. They learned the hard way that checking eligibility before starting the project is crucial.

SSIP Application Process: Step-by-Step Checklist

Applying for the Secondary Suite Incentive Program can feel overwhelming at first. There are rules to follow, permits to get, and construction to manage.

But it does not have to be confusing. Breaking the process into clear steps makes it manageable and keeps you on track.

With the right approach, you can move from planning to building a legal, income-generating suite without unnecessary stress.

1. Check Zoning & Bylaws

- Confirm your city or town allows secondary suites in your area.

- Check restrictions on suite type, size, ceiling height, parking, and setbacks.

- Ask about special rules for laneway houses or garage conversions.

- Tip: Early discussions with your local planning office can save costly surprises.

2. Prepare Your Plans

- Hire a licensed contractor or architect familiar with secondary suites.

- Include layout, plumbing, electrical, heating, and safety features.

- Ensure compliance with local building codes, fire safety, and accessibility standards.

- Tip: Incorporate energy-efficient upgrades. Some municipalities offer incentives for eco-friendly designs.

3. Submit Plans for Approval

- Submit your detailed plans to your city or municipality.

- Be prepared to make adjustments based on city feedback.

- Keep a record of all submissions, emails, and approvals. This helps streamline SSIP funding later.

4. Apply for SSIP

- Complete the official SSIP application form.

- Provide proof of ownership and confirm your property is your primary residence.

- Attach project details, cost estimates, construction timeline, and affordability compliance.

- Tip: Double-check all documentation. Missing information can delay approval.

5. Start Construction

- Begin construction only after your plans and SSIP application are approved.

- Keep detailed records of all expenses, including invoices, receipts, and contractor agreements.

- Tip: Schedule inspections during key stages such as plumbing, electrical, and framing to prevent last-minute issues.

6. Final Inspection & Funding

- City inspectors verify the suite meets building codes, safety standards, and SSIP criteria.

- Once approved, SSIP funding is disbursed. This may include partial or full loan forgiveness up to $20,000.

- Tip: Have all documentation ready. Final inspection can be delayed without proper records.

Extra Tips for a Smooth Process

- Plan your budget carefully because unexpected costs can arise. Keep a contingency fund.

- Stay in touch with your contractor to prevent misunderstandings.

- Communicate with your municipality. Early questions reduce delays.

- Consider energy efficiency. Eco-friendly suites may increase appeal and reduce costs for renters.

- Be aware of timelines because construction can take weeks to months. Plan accordingly.

How Much Can You Really Save?

Let’s get real. When it comes to secondary suites, most homeowners want to know one thing: how much money can this actually put in my pocket.

It is not just about creating extra space in your home. It is about turning unused areas into real income, offsetting mortgage costs, and even building long-term wealth.

Understanding the numbers upfront helps you see whether a secondary suite is worth the effort and investment.

Here’s the deal with SSIP

- Maximum forgivable loan: $40,000

- Forgiveness rate: 50 percent if you rent your suite affordably

- Actual benefit: Up to $20,000

Now picture this. You rent your suite for $1,200 a month. That’s $14,400 a year coming in. Over five years, you’ve earned more than $70,000 from rent alone. Add the $20,000 forgiven on your loan, and you’re looking at nearly $90,000 in total value from one program. Not bad for turning extra space in your home into cash.

Short Story

Raj in Edmonton built a secondary suite above his garage. The project cost him $65,000. He got a $40,000 SSIP loan, half of which ($20,000) was forgiven because he rented the unit affordably.

With $1,100 coming in each month, Raj expects to break even in just four years. After that, every dollar is pure income that goes straight into his pocket.

Why it’s worth it?

Secondary suites aren’t just about loan forgiveness. They let homeowners make money from space they already have, cover mortgage costs, and help provide affordable housing in their community. It’s a win-win that feels real and practical.

Why Homeowners Should Pay Attention

Let’s pause for a second.

If you are a homeowner, ask yourself:

- Do you have unused space, like a basement or garage?

- Do you want to support your family financially without selling your home?

- Would you like steady monthly income, even during retirement?

If the answer is yes to any of these, SSIP might be your golden ticket.

Short Story: A family in Mississauga converted their basement into a legal suite. The rental income helped their daughter through university. That’s not just numbers on paper. That is a real family story.

The Challenges and Hidden Costs

Secondary suites are a great way to earn income and add value to your home, but it’s important to be realistic about the challenges.

Construction costs

Building a legal suite usually costs between $50,000 and $80,000. The final amount depends on the type of suite, materials, and contractor you choose.

Permits and inspections

Getting approvals takes time. You will need patience while city inspectors review your plans, check construction at different stages, and ensure everything meets code.

Property taxes

Adding a rental unit may increase your property assessment and taxes. It is something to budget for, but it also reflects the added value of your property.

Management responsibilities

Being a landlord involves more than collecting rent. You are responsible for maintenance, tenant issues, and occasional repairs. It requires effort but also gives you control over your investment.

Look at it this way. You are not just spending money. You are creating an asset that can provide income for years, increase the value of your home, and give you long-term financial flexibility.

Pro Tips for Making the Most of SSIP

Making a secondary suite project work smoothly takes a bit of planning and some smart decisions. Here are tips from homeowners who have been through it:

Work with the right people

Hire experienced contractors, architects, and mortgage brokers. They can help avoid costly mistakes, navigate permits, and make sure the suite is designed to rent easily. A skilled team saves both money and stress.

Talk to your city early

Bylaws and rules differ between municipalities. Ask questions early about zoning, parking, suite size, and safety requirements. Knowing what is allowed before you start prevents delays, fines, or redesigns.

Think long-term

Build a suite that lasts. Use durable materials, smart layouts, and energy-efficient features. A suite that renters love will stay occupied, which means steady income and increased property value over time.

Plan your financing

Upfront costs can add up quickly. Consider options like HELOCs or mortgage refinancing through AJP Mortgage to cover construction costs without straining your budget. Plan for contingencies in case expenses rise.

Keep records

Track permits, receipts, construction photos, and inspection notes. Good documentation makes it easier to receive funding, prove compliance, and manage the project efficiently.

Consider tenants carefully

Screen tenants thoughtfully and set clear rules about rent, maintenance, and responsibilities. Happy, reliable renters reduce stress and help you maximize your income.

Don’t rush the process

Patience pays off. Take the time to plan, get approvals, and build the suite correctly. Cutting corners may save time upfront but often leads to costly problems later.

Use your suite strategically

Think beyond income. A secondary suite can help family members, provide flexible space for future needs, or even increase your home’s resale value. Plan how the space fits your long-term goals.

People Also Ask & FAQs About SSIP

Can I use SSIP to upgrade my existing basement apartment?

No. SSIP only applies to creating a new secondary suite. Renovations or upgrades to an old rental do not qualify.

What counts as “affordable rent”?

It depends on your city. Generally, affordable rent is set below the average market rent in your area to keep housing accessible.

Do I have to live in the house?

Yes. Your property must be your primary residence to qualify for SSIP.

Can I build a secondary suite in a condo or townhouse?

Usually not. The program is designed for detached or semi-detached homes with enough space for a self-contained unit.

Will my property value increase with a secondary suite?

Most likely. Homes with legal rental units often sell for more because they come with built-in income potential.

Is the SSIP loan taxable?

No. Forgivable portions of the loan are not treated as taxable income. It’s still a good idea to confirm with your accountant.

Can I apply if my credit score is low?

Credit history matters less than for a regular mortgage. The focus is on your property and project, not your personal credit.

What happens if I stop renting at affordable rates?

You may lose the forgiven portion of the loan and could be required to repay more of the funding.

Final Thoughts: Is SSIP Worth It?

Here’s the honest truth. The Secondary Suite Incentive Program is not for everyone. If you are not comfortable being a landlord or managing construction costs, it can feel overwhelming.

But for many homeowners, it is an opportunity that is hard to ignore. By creating a secondary suite, you are:

- Providing affordable housing

- Building long-term wealth

- Helping your community

And the benefits go beyond numbers. That basement or garage suite might pay for your child’s education, cover rising expenses, or give you extra security in retirement.

Let’s Talk About Your Options

At AJP Mortgage, we’ve helped countless Canadian homeowners make programs like SSIP work for them. From financing guidance to connecting you with experienced contractors and architects, we make the process smoother and less stressful.

If you are curious about whether SSIP is right for your home, reach out today. We can explore how you can build a secondary suite, earn extra income, and even get part of your loan forgiven. Your home could become a source of income and opportunity, and we can help you make it happen.